| ||

| ||

| ||

| ||

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant¨ Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Westamerica Bancorporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which the transaction applies: |

| (2) | Aggregate number of securities to which the transaction applies: |

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of the transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

1108 Fifth Avenue

San Rafael, California 94901

March 19, 200714, 2008

To Our Shareholders:

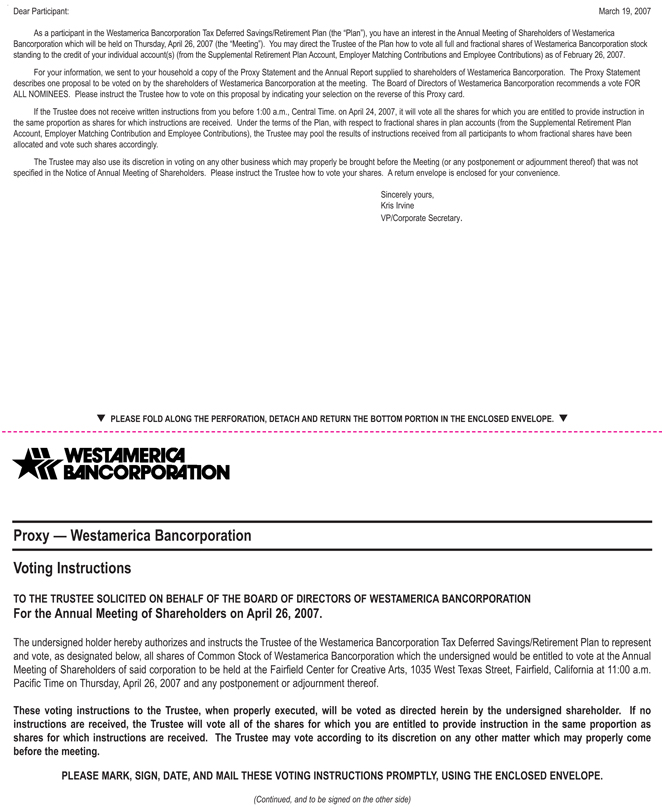

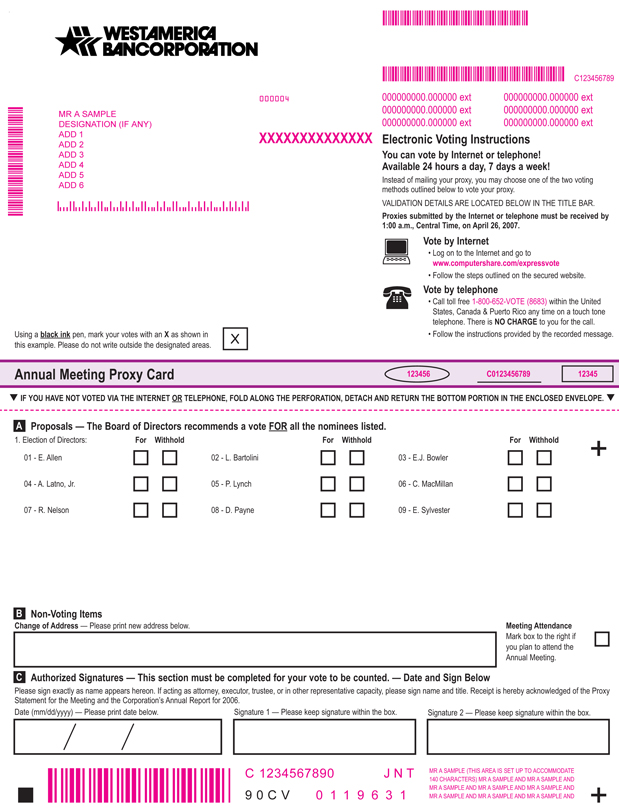

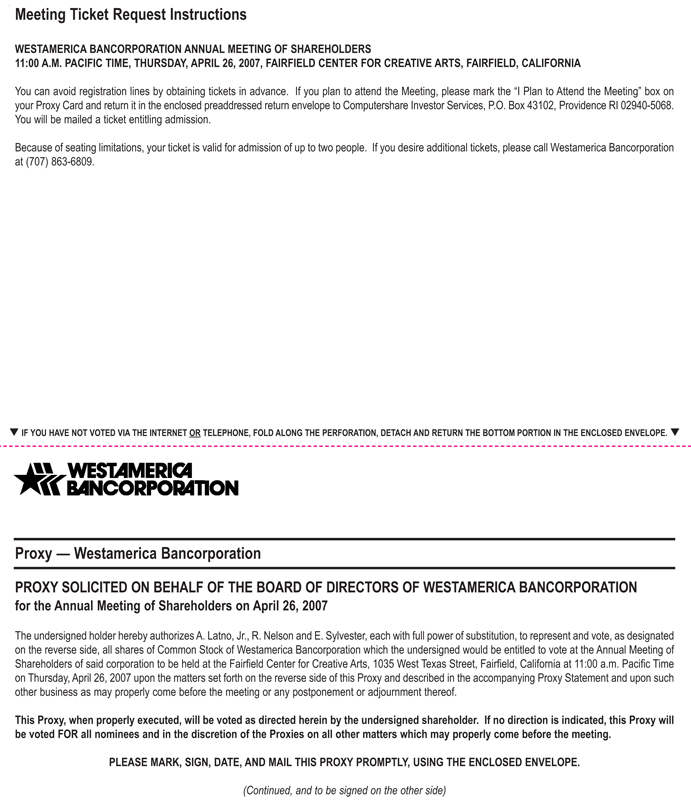

You are cordially invited to attend the Annual Meeting of Shareholders of Westamerica Bancorporation. It will be held at11:00 a.m. Pacific Time on Thursday, April 26, 2007,24, 2008, at the Fairfield Center for Creative Arts, 1035 West Texas Street, Fairfield, Californiaas stated in the formal notice accompanying this letter. We hope you will plan to attend.

At the Annual Meeting, the Shareholders will be asked to elect Directors and to conduct any other business that properly comes before the Annual Meeting.

In order to ensure your shares are voted at the Annual Meeting, you can vote through the Internet, by telephone or by mail. Instructions regarding Internet and telephone voting are included on the Proxy Card. If you elect to vote by mail, please sign, date and return the Proxy Card in the accompanying postage-paid envelope. The Proxy Statement explains more about voting. If you attend the Annual Meeting, you may vote in person even though you previously voted your proxy.

We look forward to seeing you at the Annual Meeting on Thursday, April 26, 2007,24, 2008, at the Fairfield Center for Creative Arts.

| Sincerely, |

|

|

|

Chairman of the Board, President and

|

WESTAMERICA BANCORPORATION

1108 Fifth Avenue

San Rafael, California 94901

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Date and Time

Thursday, April 26, 2007,24, 2008, at 11:00 a.m. Pacific Time

Place

Fairfield Center for Creative Arts, 1035 West Texas Street, Fairfield, California

Items of Business

1. To elect nine Directors to serve until the 20082009 Annual Meeting of Shareholders; and

2. To transact such other business as may properly come before the Annual Meeting and any adjournments or postponements.

Who Can Vote?

Shareholders of record at the close of business on February 26, 200725, 2008 are entitled to notice of and to vote at the Annual Meeting or any postponement or adjournment thereof.

Admission to the Meeting

Admission to the Meeting will require a ticket. If you are a Shareholder of record and plan to attend, please check the appropriate box on the Proxy Card and an admission ticket will be mailed to you. If you are a Shareholder whose shares are held through an intermediary, such as a bank or broker, and you plan to attend, please request a ticket by writing to the Shareholder Relations Department A-2B, Westamerica Bancorporation, P.O. Box 1250, Suisun City, California 94585-1250. Evidence of your ownership, which you can obtain from your bank, broker or other intermediary, must accompany your letter.

Annual Report

Westamerica Bancorporation’s Annual Report on Form 10-K (“Annual Report”) to Shareholders for the fiscal year ended December 31, 20062007 is enclosed. The Annual Report contains financial and other information about the activities of Westamerica Bancorporation, but does not constitute a part of the proxy soliciting materials.

BY ORDER OF THE BOARD OF DIRECTORS |

|

| Kris Irvine |

|

|

VP/Corporate Secretary |

Dated: March 19, 200714, 2008

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

SHAREHOLDER MEETING BEING HELD ON THURSDAY, APRIL 24, 2008. THE PROXY STATEMENT

AND ANNUAL REPORT ON FORM 10-K TO SHAREHOLDERS ARE AVAILABLE AT:

WWW.WESTAMERICA.COM/INVESTOR_RELATIONS/INDEX.HTML

YOUR VOTE IS IMPORTANT

YOU ARE URGED TO COMPLETE, SIGN, DATE AND PROMPTLY RETURN YOUR PROXY, OR VOTE BY TELEPHONE OR THE INTERNET USING THE PROCEDURES DESCRIBED IN THE PROXY STATEMENT, SO THAT YOUR SHARES MAY BE VOTED IN ACCORDANCE WITH YOUR WISHES.

| 1 | ||

| 3 | ||

| 3 | ||

| 5 | ||

| 6 | ||

| 6 | ||

| 8 | ||

| 11 | ||

Option Exercises and Stock Vested Table for Fiscal Year | ||

Nonqualified Deferred Compensation Table for Fiscal Year | ||

WESTAMERICA BANCORPORATION

1108 Fifth Avenue

San Rafael, California 94901

PROXY STATEMENT

March 19, 200714, 2008

This Proxy Statement and the accompanying Proxy Card are being mailed to Shareholders of Westamerica Bancorporation (“Westamerica” or the “Corporation”) beginning on or about March 19, 2007.14, 2008. The Westamerica Board of Directors is soliciting proxies to be used at the 20072008 Annual Meeting of Westamerica Shareholders, which will be held at 11:00 a.m. Pacific Time, Thursday, April 26, 2007,24, 2008, or at any adjournment or postponement of the Meeting. Proxies are solicited to give all Shareholders of record (“Record Holder”) an opportunity to vote on matters to be presented at the Annual Meeting. In the following pages of this Proxy Statement, you will find information on matters to be voted on at the Annual Meeting.

Who Can Vote.You are entitled to vote if you were aRecord Holderof Westamerica common stock as of the close of business on February 26, 2007.25, 2008. Your shares can be voted at the Meeting only if you are present or represented by a valid proxy. If your shares of common stock are held by a bank, broker or other nominee in “street name,” you are a “beneficial“beneficial owner”and will receive voting instructions from the bank, broker or other nominee (including instructions, if any, on how to vote by telephone or through the Internet). You must follow these instructions in order to have your shares voted.

Voting In Person at the Meeting.To be able to vote in person at the Annual Meeting, beneficial owners must obtain and bring to the Annual Meeting a legal proxy from the institution that holds your shares, indicating that you were the beneficial owner of the shares on February 26, 2007,25, 2008, the Record Date for voting.

Proxy Card.The Board has designated Arthur C. Latno, Jr., Ronald A. Nelson and Edward B. Sylvester to serve as Proxies for the Annual Meeting. As Proxies, they will vote the shares represented by proxies at the Annual Meeting. If you sign, date and return your Proxy Card but do not specify how to vote your shares, they will be voted by the Proxies in favor of the election of all of the Director nominees. The Proxies will also have discretionary authority to vote in accordance with their judgment on any other matter that may properly come before the Meeting that we did not have notice of by February 3, 2007.2008.

Quorum and Shares Outstanding.A quorum, which is a majority of the total shares outstanding as of the Record Date, must be present to hold the Meeting. A quorum is calculated based on the number of shares represented by Shareholders attending in person or by proxy. On February 26, 2007, 30,321,61925, 2008, 28,890,389 shares of Westamerica common stock were outstanding. We also count broker non-votes, which we describe below, as shares present or represented at the Meeting for the purpose of determining whether a quorum exists.

1

Required Votes – Election of Director Nominees.Each share is entitled to one vote, except in the election of Directors where a Shareholder may cumulate votes as to candidates nominated prior to voting, but only when a Shareholder gives notice of intent to cumulate votes prior to the voting at the Meeting. If any Shareholder gives such notice, all Shareholders may cumulate their votes for nominees. Under cumulative voting, each share carries as many votes as the number of Directors to be elected, and the Shareholder may cast all of such votes for a single nominee or distribute them in any manner among as many nominees as desired. In the election of Directors, the nine nominees receiving the highest number of votes will be elected. If your proxy is marked “Withhold” with regard to the election of any nominee, your shares will be counted toward a quorum but they will not be voted for or against the election of that nominee.

Other Matters.Approval of any other matter considered at the Meeting will require the affirmative vote of a majority of the shares present or represented by proxy and voting at the Meeting.

Broker Non-Votes.Broker non-votes will be included as “present” for the purpose of determining the presence of a quorum. A broker non-vote occurs under the stock exchange rules when a broker is not permitted to vote on a matter without instructions from the beneficial owner of the shares and no instruction is given on a timely basis. Brokers may vote at their discretion on routine matters, such as the election of Directors, but not on non-routine matters.

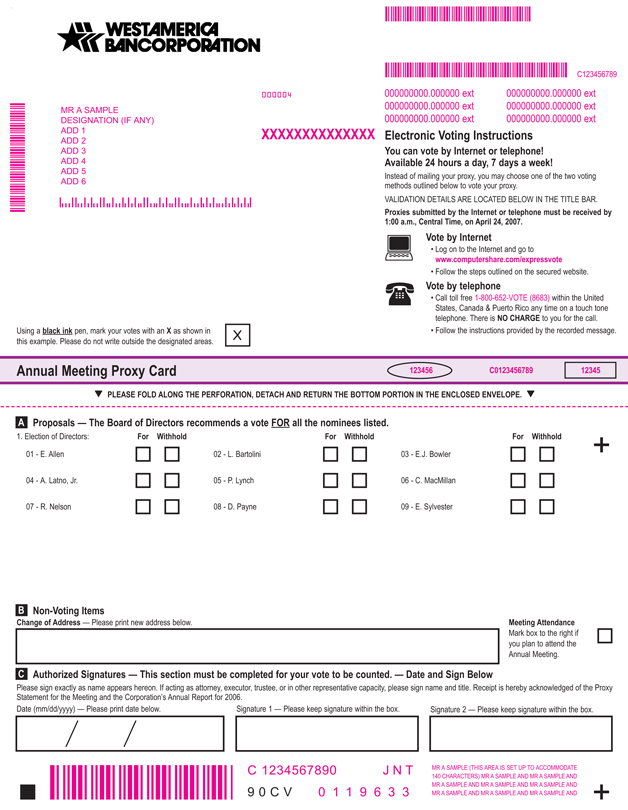

How You Can Vote.Record Holders may vote by proxy or in person at the Meeting. To vote by proxy, you may select one of the following options:

Vote by Telephone.You can vote your shares by telephone by calling the toll-free telephone number shown on your Proxy Card. Telephone voting is available 24 hours a day, seven days a week. Easy-to-follow voice prompts allow you to vote your shares and confirm that your instructions have been properly recorded. Our telephone voting procedures are designed to authenticate the Shareholder by using individual control numbers, which you will find on your Proxy Card. If you vote by telephone, you shouldNOTreturn your Proxy Card.

Vote by Internet.You can choose to vote on the Internet. The website for Internet voting is shown on your Proxy Card. Internet voting is available 24 hours a day, seven days a week. You will be given the opportunity to confirm that your instructions have been properly recorded. Our Internet voting procedures are designed to authenticate the Shareholder by using individual control numbers, which you will find on your Proxy Card. If you vote on the Internet, you shouldNOTreturn your Proxy Card.

If you vote by telephone or Internet, your vote must be received by 1:00 a.m. Central Time, on April 26, 200724, 2008 to ensure that your vote is counted. For Westamerica Bancorporation Tax Deferred Savings/Retirement Plan (ESOP) participants, your vote must be received by 1:00 a.m. Central Time, on April 24, 2007.22, 2008.

Vote by Mail.If you choose to vote by mail, simply mark your Proxy Card, date and sign it, and return it in the postage-paid envelope provided.

We have been advised by counsel that these telephone and Internet voting procedures comply with California law.

Revocation of Proxy.Record Holdersholders, who vote by proxy, whether by telephone, Internet or mail, may revoke that proxy at any time before it is voted at the Meeting. You may do this by: (a) signing another Proxy Card with a later date and delivering it to us prior to the Meeting or sending a notice of revocation

2

to the Corporate

Secretary of Westamerica at 1108 Fifth Avenue, San Rafael, CA 94901; (b) voting at a later time by telephone or on the Internet prior to 1:00 a.m. Central Time, on April 26, 200724, 2008 (April 24, 200722, 2008 for ESOP participants); or (c) attending the Meeting in person and casting a ballot. If you hold shares in street name, you may change your vote by submitting new voting instructions to your broker or other nominee.

Householding.As permitted by the Securities Exchange Act of 1934 (the “Exchange Act”) only one copy of the Annual Report and the Proxy Statement is being delivered to Shareholders residing at the same address, unless such Shareholders have notified their bank, broker, Computershare Investor Services or other holder of record that they wish to receive separate mailings. If you are a beneficial holder and own your shares in street name, contact your broker, bank or other holder of record to discontinue householding and receive your own separate copy of Proxy Statements and Annual Reports in future years. If you are a registered holder and own your shares through Computershare Investor Services, contact Computershare toll-free at 877-588-4258 or in writing directed to Computershare Investor Services, 250 Royall Street, Mail Stop 1A, Canton, MA 02021 to discontinue householding and receive multiple Annual Reports and Proxy Statements in future years. To receive an additional Annual Report or Proxy Statement this year, contact Shareholder Relations at 707-863-6992.

At least one account at your address must continue to receive an Annual Report, unless you elect to receive future Annual Reports and Proxy Statements over the Internet. Mailing of dividends, dividend reinvestment statements, and special notices will not be affected by your election to discontinue duplicate mailings of the Annual Report and Proxy Statement. Regardless of householding, each Shareholder will continue to receive a separate Proxy Card and return envelope.

Electronic Access to Proxy Materials and Annual Reports.This Proxy Statement and the 20062007 Annual Report are available on the Corporation’s Internet site atat:www.westamerica.com/investor_relations/index.html.If you hold your Westamerica common stock in street name through a broker, a bank or other nominee, you may have the option of securing your Proxy Statement and Annual Report over the Internet. If you vote this year’s proxy electronically, you may also be able to elect to receive future Proxy Statements, Annual Reports and other materials electronically by following the instructions given by your bank, broker, or other holder of record when you vote.

Security Ownership of Certain Beneficial Owners.Based on Schedule 13G filings, Shareholders beneficially holding more than 5% of Westamerica common stock outstanding as of December 31, 2006,2007, in addition to those disclosed in the Security Ownership of Directors and Management below, were:

Name and Address of Beneficial Owner | Title of Class | Number of Shares

| Percent of

| |||||

T. Rowe Price Associates, Inc. 1100 East Pratt Street, Baltimore MD 21202-1009 | Common | (1) | ||||||

| ||||||||

| % | |||||||

Neuberger Berman, Inc. 605 Third Avenue, New York, New York 10158 | Common | (2) | ||||||

| ||||||||

| % | |||||||

Barclays Global Investors, N.A. Barclays Global Fund Advisors 44 Fremont Street, San Francisco, CA 94105 | Common | (3) | ||||||

| ||||||||

| ||||||||

| % | |||||||

3

(1) | The Schedule 13G disclosed that the reporting entity held sole voting power over |

securities. For purposes of the reporting requirements of the Securities Exchange Act of 1934, Price Associates is deemed to be a beneficial owner of such securities; however, Price Associates expressly disclaims that it is, in fact, the beneficial owner of such securities. |

(2) | The Schedule 13G disclosed that the reporting entity held sole voting power over |

(3) | The Schedule 13G disclosed that the reporting entity, through its subsidiaries Barclays Global Fund Advisors and Barclays Global Investors, NA (“Barclays”), held sole voting power over |

Security Ownership of Directors and Management.The following table shows the number of common shares and the percentage of the common shares beneficially owned (as defined below) by each of the current Directors, by the Chief Executive Officer (“CEO”), by the Chief Financial Officer (“CFO”), and by the three other most highly compensated executive officers, during 2006, and by all Directors and Officers of the Corporation as a group as of February 26, 2007.25, 2008. For the purpose of the disclosure of ownership of shares by Directors and Officers below, shares are considered to be “beneficially” owned if a person, directly or indirectly, has or shares the power to vote or direct the voting of the shares, the power to dispose of or direct the disposition of the shares, or the right to acquire beneficial ownership of shares within 60 days of February 26, 2007.25, 2008.

Amount and Nature of Beneficial Ownership

| Amount and Nature of Beneficial Ownership | ||||||||||||||||||||||||||||

Name and Address** | Sole Voting and | Shared Voting and Investment Power | Right to Feb. 26, 2007 | Total(1) | Percent of Class* (2) | Sole Voting and Investment Power | Shared Voting and Investment Power | Right to Acquire Within 60 days of Feb. 26, 2007 | Total(1) | Percent of Class(2) | ||||||||||||||||||

Etta Allen | 10,744 | (3) | 10,744 | * | 10,753 | (3) | 10,753 | * | ||||||||||||||||||||

Louis E. Bartolini | 1,800 | 1,800 | * | 1,800 | 1,800 | * | ||||||||||||||||||||||

E. Joseph Bowler | 17 | 25,867 | (4) | 25,884 | 0.1 | % | 17 | 25,867 | (4) | 25,884 | 0.1 | % | ||||||||||||||||

Arthur C. Latno, Jr. | 3,238 | (5) | 3,238 | * | 3,259 | (5) | 0 | 3,259 | * | |||||||||||||||||||

Patrick D. Lynch | 1,000 | 1,000 | * | 1,000 | 0 | 1,000 | * | |||||||||||||||||||||

Catherine Cope MacMillan | 6,100 | (6) | 6,100 | * | 6,300 | (6) | 0 | 6,300 | * | |||||||||||||||||||

Ronald A. Nelson | 44,000 | 44,000 | 0.2 | % | 44,000 | 0 | 44,000 | 0.2 | % | |||||||||||||||||||

David L. Payne | 921 | (7) | 742,942 | (8) | 1,731,127 | 2,474,990 | 7.7 | % | 921 | (7) | 763,770 | (8) | 1,574,348 | 2,339,039 | 7.7 | % | ||||||||||||

Edward B. Sylvester | 86,000 | 86,000 | 0.3 | % | 87,000 | 0 | 87,000 | 0.3 | % | |||||||||||||||||||

Robert A. Thorson | 859 | (9) | 3,159 | (10) | 78,026 | (11) | 82,044 | 0.3 | % | |||||||||||||||||||

John “Robert” A. Thorson | 859 | (9) | 3,549 | (10) | 95,334 | (11) | 99,742 | 0.3 | % | |||||||||||||||||||

Jennifer J. Finger | 1,127 | 866 | 155,817 | (11) | 157,810 | 0.5 | % | 1,127 | 1,033 | 170,195 | (11) | 172,355 | 0.6 | % | ||||||||||||||

Frank R. Zbacnik | 36 | 8,812 | 36,246 | (11) | 45,094 | 0.2 | % | 36 | 9,215 | 49,262 | (11) | 58,513 | 0.2 | % | ||||||||||||||

Dennis R. Hansen | 250 | 19,609 | 88,147 | (11) | 108,006 | 0.4 | % | 0 | 20,348 | 93,561 | (11) | 113,909 | 0.4 | % | ||||||||||||||

All 14 Directors and Executive Officers as a Group | 156,092 | 802,498 | 2,110,980 | 3,069,570 | 9.47 | % | ||||||||||||||||||||||

All 15 Directors and Executive Officers as a Group | 157,176 | 825,211 | 2,092,629 | 3,075,016 | 9.9 | % | ||||||||||||||||||||||

| * | Indicates beneficial ownership of less than one-tenth of one percent (0.1%) of the Corporation’s Common Stock. |

| ** | The address of all persons listed is 1108 Fifth Avenue, San Rafael, CA 94901. |

4

(1) | None of the shares held by the Directors and Officers listed |

(2) | In calculating the percentage of ownership, all shares which the identified person or persons have the right to acquire by exercise of options are deemed to be outstanding for the purpose of computing the percentage of the class owned by such person, but are not deemed to be outstanding for the purpose of computing the percentage of the class owned by any other person. |

(3) | Includes 10,350 shares held in a trust as to which Mrs. Allen is trustee. |

(4) | Includes 25,867 shares held in trust as to which Mr. Bowler is co-trustee with shared voting and investment power. |

(5) | Includes 1,115 shares owned by Mr. Latno’s wife as to which Mr. Latno disclaims beneficial ownership. |

(6) | Includes 5,000 shares held in a trust as to which Ms. MacMillan is trustee. |

(7) | Includes 921 shares held in |

(8) | Includes 528,837 shares owned by Gibson Radio and Publishing Company, of which Mr. Payne is President and Chief Executive Officer, as to which Mr. Payne disclaims beneficial ownership, and 203,116 shares held in a trust as to which Mr. Payne is co-trustee with shared voting and investment power. |

(9) | Includes 830 shares held in |

(10) | Includes |

(11) | During 1996, the Corporation adopted the Westamerica Bancorporation Deferral Plan (the “Deferral Plan”) that allows recipients of Restricted Performance Shares (“RPS”) to defer receipt of vested RPS shares into succeeding years. Amounts shown include RPS shares that have been deferred into the Deferral Plan for the following accounts in amounts of: Ms. Finger— |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Corporation’s Directors and Executive Officers and persons who own more than 10% of a registered class of the Corporation’s equity securities to file with the SEC and NASDAQ initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Corporation, and to send a copy to the Corporation.

To the Corporation’s knowledge and based solely on a review of the copies of reports furnished to the Corporation and written representations that no other reports were required, during the fiscal year ended December 31, 2006,2007, all Section 16(a) filing requirements were timely complied with by Westamerica’s officers and Directors.

5Directors, except for an administrative error for Ms. Finger with respect to the vesting of a stock award and the granting of an stock option on January 25, 2007. The Form 4 was timely transmitted but rejected by the SEC for improper coding. Upon discovery of the rejection on January 31, 2007, a corrected Form 4 was immediately submitted.

Proposal 1 – — Election Ofof Directors

Nine Directors have been nominated for election at the Meeting to hold office for the ensuing year andor until their successors are elected and qualified. The Proxies will vote for the nine nominees named below unless you give different voting instructions on your Proxy Card. Each nominee is presently a Director of the Corporation and has consented to serve a new term. The Board does not anticipate that any of the nominees will be unavailable to serve as a Director, but if that should occur before the Meeting, the Board reserves the right to substitute another person as nominee. The Proxies will vote for any substitute nominated by the Board of Directors. The Proxies may use their discretion to cumulate votes for election of Directors and cast all of such votes for any one or more of the nominees, to the exclusion of the others, and in such order of preference as they may determine at their discretion.

The nominees for election as Directors are named and certain information with respect to them is given below. The information has been furnished to the Corporation by the respective nominees. All of the nominees have engaged in their indicated principal occupation for more than five years, unless otherwise indicated.

Name of Nominee | Principal Occupation | Director Since | ||

Etta Allen | Mrs. Allen, Sheet Metal of Greenbrae, California, and President and owner of Sunny Slope Vineyard, Glen Ellen, California. | 1988 | ||

Louis E. Bartolini | Mr. Bartolini, and financial consultant with Merrill Lynch, Pierce, Fenner & Smith, Inc. He currently devotes some of his time to serving on various community service boards. | 1991 | ||

E. Joseph Bowler | Mr. Bowler, and Treasurer of the Corporation. Currently, he serves as a director and trustee of various non-profit community organizations. | 2003 | ||

Arthur C. Latno, Jr. | Mr. Latno, Pacific Telesis Group (formerly Pacific Telephone Co.) in San Francisco, California. Mr. Latno retired from that company in November of 1992. He currently devotes some of his time to serving on various community service boards. | 1985 | ||

Patrick D. Lynch | Mr. Lynch, several private high technology firms. | 1986 | ||

|

| |||

Properties, Inc., the owner of the Huntington Hotel in

San Francisco, California. Prior to 2000, she was President and

owner of the Firehouse Restaurant in Sacramento, California.

6

Name of Nominee | Principal Occupation | Director | ||

Catherine Cope MacMillan | Ms. MacMillan, 60, is General Counsel for Nob Hill Properties, Inc., the owner of the Huntington Hotel in San Francisco, California. Prior to 2000, she was President and owner of the Firehouse Restaurant in Sacramento, California. | 1985 | ||

| Ronald A. Nelson | Mr. Nelson, Charles M. Schulz Creative Associates, and a general partner in various Schulz partnerships through 1995. He has long been involved in the development of commercial property and also devotes time to personal investments and business consulting. | 1988 | ||

David L. Payne | Mr. Payne, and Chief Executive Officer of the Corporation. Mr. Payne is President and Chief Executive Officer of Gibson Printing and Publishing Company and Gibson Radio and Publishing Company, which are newspaper, commercial printing and real estate investment companies headquartered in Vallejo, California. | 1984 | ||

Edward B. Sylvester | Mr. Sylvester, which is a civil engineering and planning firm in Nevada City, California. Mr. Sylvester is also the Broadcasters which owns radio stations in Nevada and Yuba counties. | 1979 | ||

THE BOARD RECOMMENDS ELECTION OF ALL NOMINEES.

7

Board of Directors and Committees

Director Independence

The Board of Directors has considered whether any relationships or transactions related to a Director were inconsistent with a Director’s independence. Based on this review, the Board has determined that E. Allen, L.E. Bartolini, E.J. Bowler, A.C. Latno, Jr., P.D. Lynch, C.C. MacMillan, R.A. Nelson, C.R. Otto(1), and E.B. Sylvester are “independent“independent” Directors,”“ as defined in NASDAQ’SNASDAQ rules.

Meetings

The Corporation expects all board members to attend all meetings, including the Annual Meeting of Shareholders, except for reasons of health or special circumstances. Last year all tennine Directors attended the Annual Meeting. The Board held a total of 11 meetings during 2006.2007. Every Director attended at least 75% of the aggregate of: (i) the Board Meetings held during that period in which they served; and (ii) the total number of meetings of any Committee of the Board on which the Director served.

Committees of the Board

Executive Committee:

Members:D.L. Payne, Chairman; A.C. Latno, Jr., P.D. Lynch and E.B. Sylvester.

Number of Meetings in 2006:2007:Ten

Functions:The Board delegates to the Executive Committee any powers and authority of the Board in the management of the business affairs of the Corporation, which the Board is allowed to delegate under California law.

Audit Committee:

Members:R.A. Nelson, Chairman; L.E. Bartolini, E.J. Bowler, and C.C. MacMillan and E.J. Bowler.MacMillan.

The Board of Directors has determined that all members are independent, as that term is defined by applicable rules of NASDAQ. The Board has also designated Mr. Nelson as the “Audit Committee financial expert” as defined by the rules of the SEC and is “financially sophisticated” under NASDAQ rules. In concluding that Mr. Nelson is the Audit Committee financial expert, the Board determined that he has:

an understanding of generally accepted accounting principles and financial statements;

the ability to assess the general application of such principles in connection with the accounting for estimates, accruals and reserves;

experience preparing, auditing, analyzing or evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised by the Corporation’s financial statements, or experience actively supervising one or more persons engaged in such activities;

the ability to assess the general application of such principles in connection with the accounting for estimates, accruals and reserves;

experience preparing, auditing, analyzing or evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised by the Corporation’s financial statements, or experience actively supervising one or more persons engaged in such activities;

an understanding of internal control over financial reporting; and

an understanding of audit committee functions.

Designation of a person as an Audit Committee financial expert does not result in the person being deemed an expert for any purpose, including under Section 11 of the Securities Act of 1933. The designation does not impose on the person any duties, obligations or liability greater than those imposed on any other Audit Committee member or any other Director and does not affect the duties, obligations or liability of any other member of the Audit Committee or Board of Directors.

|

|

8

Number of Meetings in 2006:2007:Five

Functions:The Audit Committee provides independent, objective oversight of the integrity of the Corporation’s financial statements, the Corporation’s compliance with legal and regulatory requirements, the independence and performance of the Corporation’s independent auditor as it performs audit, review or attest services, and the Corporation’s internal audit and control function. It selects and retains the independent auditors, reviews the plan and the results of the auditing engagement andengagement. It acts pursuant to a written charter that was amended by the Board on January 25, 2007 and iswas attached as Exhibit A.an exhibit to the Proxy Statement for the 2007 Annual Meeting of Shareholders. The Audit Committee Report that follows below more fully describes the responsibilities and the activities of the Audit Committee.

Employee Benefits and Compensation Committee:

Members:P.D. Lynch, Chairman; E. Allen, A.C. Latno, Jr., and R.A. Nelson.

The Employee Benefits and Compensation Committee of the Board of Directors (the “Compensation Committee”) is comprised solely of Directors who are not current or former employees of Westamerica or any of its affiliates. They are independent as defined by NASDAQ rules.

Number of Meetings in 2006:2007:Five

Functions:The Compensation Committee administers the Corporation’s stock option plan,Amended and Restated Stock Option Plan of 1995, the tax deferred savingsTax Deferred Savings and retirement planRetirement Plan and the profit sharing plan.Profit Sharing Plan, the Westamerica Bancorporation and Subsidiaries Deferred Compensation Plan and the Westamerica Bancorporation Deferral Plan. It administers the Corporation’s compensation and reviews and reports to the Board the compensation level for executive officers, including the CEO, of the Corporation and its subsidiaries.

The Compensation Committee determines annual corporate performance objectives for equity compensation and cash bonuses and their related corporate, divisional and individual targets.goals. Based on the CEO’s assessment of the extent, to which each executive officer met those objectives and targets,goals, the Committee determines each executive officer’s annual equity compensation and cash bonus. The Compensation Committee also establishes the individual goals and targets for the CEO. All compensation recommendations of the Compensation Committee must be reviewed by the full Board of Directors. The role of the Compensation Committee is described in greater detail under the section entitled “Compensation Discussion and Analysis.”

The Compensation Committee does not have a charter, as it is not required by NASDAQ rules. The Compensation Committee has the authority to seek assistance from officers and employees of the Corporation as well as external legal, accounting and other advisors. It has not retained outside consultants for compensation advice, but can request assistance on an as needed basis. It does not delegate authority to anyone outside of the Compensation Committee. The Human Resources Department supports the Compensation Committee by fulfilling certain administrative duties regarding the compensation programs.

Nominating Committee:

Members:A.C. Latno, Jr., Chairman; P.D. Lynch, and E.B. Sylvester.

The Board of Directors has determined that all members are independent, as defined in the rules of NASDAQ.NASDAQ rules.

Number of Meetings in 2006:2007:One

Functions:The Nominating Committee is governed by a written charter, which was amended January 25, 2007 and iswas attached as Exhibit B.

9

an exhibit to the Proxy Statement for the 2007 Annual Meeting of Shareholders The Nominating Committee screens and recommends qualified candidates for Board membership. This Committee recommends a slate of nominees for each Annual Meeting. As part of that process, it evaluates and considers all candidates submitted by Shareholders in accordance with the Corporation’s bylaws, and considers each existing Board member’s contributions. The Committee applies the same evaluation standards whether the candidate was recommended by a Shareholder or otherwise.

Nominating Directors:The Nominating Committee will consider Shareholder nominations submitted in accordance with Section 2.14 of the Bylaws of the Corporation. That section requires, among other things, that nominations be submitted in writing and must be received by the Corporate Secretary at least 45 days before the anniversary of the date on which the Corporation first mailed its proxy materials for the prior year’s Annual Meeting of Shareholders. If the date for the current year’s Annual Meeting changes more than 30 days from the date on which the prior year’s meeting was held, the Corporation must receive notice a reasonable time before the Corporation mails its proxy materials for the current year.

Nominations must include the following information:

The name and address of proposed nominee;

The principal occupation of the nominee;

The total number of shares of capital stock of the Corporation that the Shareholder expects will be voted for the nominee;

The name and address of the notifying Shareholder; and

The number of shares of capital stock of the Corporation owned by the notifying Shareholder.

The Committee has specified the following minimum qualifications it believes must be met by a nominee for a position on the Board:

Appropriate personal and professional attributes to meet the Corporation’s needs;

Highest ethical standards and absolute personal integrity;

Physical and mental ability to contribute effectively as a Director;

Willingness and ability to participate actively in Board activities and deliberations;

Ability to approach problems objectively rationally and realistically;

Ability to respond well and to function under pressure;

Willingness to respect the confidences of the Board and the Corporation;

Willingness to devote the time necessary to function effectively as a Board member;

Possess independence necessary to make unbiased evaluation of management performance;

Be free of any conflict of interest that would violate applicable law or regulation or interfere with ability to perform duties;

Broad experience, wisdom, vision and integrity;

Understanding of the Corporation’s business environment; and

Significant business experience relevant to the operations of the Corporation.

Loan and Investment Committee:

Members:E.B. Sylvester, Chairman; E. Allen, C.R. Otto(1), A.C. Latno, Jr. and C.C. MacMillan.

Number of Meetings in 2006:2007:Ten

Functions:This Committee reviews major loans, and investment policies, and monitors the Community Reinvestment Act compliance.

The following table and footnotes provide information regarding the compensation paid to the Corporation’s non-employee members of the Board of Directors in the fiscal year 2007. Directors who are employees of the Corporation receive no compensation for their services as Directors.

Director Compensation Table for Fiscal Year 2007

Name(1) | Fees Earned Paid in Cash | Change in Pension Value and Nonqualified Deferred Compensation Earnings(2) | Total | |||

Etta Allen | 36,200 | 24,250 | 60,450 | |||

Louis E. Bartonini | 30,200 | 283 | 30,483 | |||

E. Joseph Bowler | 30,200 | 0 | 30,200 | |||

Arthur C. Latno, Jr. | 43,300 | 0 | 43,300 | |||

Patrick D. Lynch | 38,050 | 0 | 38,050 | |||

Catherine Cope MacMillan | 36,200 | 0 | 36,200 | |||

Ronald A. Nelson | 34,450 | 0 | 34,450 | |||

Carl R. Otto(3) | 5,300 | 5,254 | 10,554 | |||

Edward B. Sylvester | 38,450 | 4,643 | 43,093 |

(1) | Non-employee directors did not receive options or stock awards. During 2007, non-employee Directors of the Corporation each received an annual retainer of $14,000. Each non-employee Director received $1,200 for each meeting of the Board attended and $600 for each Committee meeting attended. The Chairman of each Committee received an additional $250 for each Committee meeting attended. All non-employee Directors are reimbursed for expenses incurred in attending Board and Committee meetings. The Chairman of the Board, David L. Payne, is compensated as an employee and did not receive any compensation as a director. The Deferred Compensation Plan allows non-employee Directors to defer some or all of their Director compensation with interest earnings credited on deferred compensation accounts. |

(2) | The amount shown is the interest on Nonqualified Deferred Compensation that exceeds 120% of the long-term Applicable Federal Rate, with compounding, on all cash compensation deferred in 2007 and in previous years. |

(3) | Mr. Carl R. Otto passed away on February 11, 2007. |

10Westamerica Bancorporation does not have a charitable donations program for Directors nor does it make donations on behalf of any Director(s). The Corporation may make a nominal donation through its Community Relations program to non-profit organizations where a Director(s) may have an affiliation.

Compensation Discussion & Analysis

The Compensation Committee governs the executive compensation program that combines three compensation elements: base salary, annual non-equity cash incentives, and long-term stock grants.

Several compensation philosophies and practices underlie this program:

Base salaries for participants in this program should be limited to foster an environment where incentive compensation motivates and rewards corporate, divisional, and individual performance.

Incentive compensation (annual non-equity cash incentives and long-term stock grants) is based on measurement of performance against pre-established objective measurable goals. Specific criteria for each objective are established for “threshold,” “target,” and “outstanding” performance. On any one measure, performance below “threshold” results in no credit for that objective. “Threshold” performance results in a 75% achievement, “target” performance results in 100% achievement, and “outstanding” performance results in 150% achievement. The performance achievement level determines the size of incentive compensation awards.

Short-term annual “target” non-equity cash incentives should bring total cash compensation (salary plus cash incentive) to average total cash compensation for the relevant job position. Actual cash incentives depend on achievement of corporate, divisional, and individual objectives. Above average performance, as measured by achievement of objectives, will result in above target cash incentives bringing total cash compensation above average through cash incentives, rather than base salary. This minimizes the effect of fixed base salary and clearly ties annual cash incentive amounts to achievement of objectives. Failure on a significant element of performance, especially the individual component, may result in no cash incentive. The cash incentive formula has the following components:

Long-term incentive stock grants will be awarded to senior management if the corporate performance level is rated “threshold” or better. The purpose of long-term incentive grants is to:

motivate senior management to focus on long-term performance;

build equity ownership among Westamerica’s senior management;

link Shareholder interests to management incentives, and

create ownership mentality among senior management.

The size of stock grants is determined by Westamerica’s corporate performance. Specific criteria for each corporate objective are established for “threshold,” “target,” and “outstanding” performance. The level of performance determines the size of incentive compensation awards.

|

|

11

Establishing Incentive Levels, Determining Objectives and Measuring Performance

In administering the executive compensation program, the Compensation Committee determines “target” incentives for each position annually, expressed as a percentage of base pay.annually. The Compensation Committee exercises discretion in establishing “target” incentives in an effort to provide competitive pay practices while motivating and rewarding performance that benefits the Corporation’s long-term financial performance and Shareholder interests.

At the beginning of each calendar year, the Compensation Committee establishes annual corporate performance objectives. In establishing corporate performance objectives, the Compensation Committee takes into consideration the current operating environment for the commercial banking industry as well as internal management policies and practices which would, in the Compensation Committee’s opinion, benefit the long-term interests of the Corporation and its Shareholders. The Compensation Committee monitors the banking industry’s operating environment throughout the ensuing year, and may exercise discretion in adjusting corporate performance objectives during the year.

The operating environment for the commercial banking industry is impacted by a myriadmyriads of factors including, but not limited to, local, national and global economic conditions, interest rate levels and trends, monetary policies of the Federal Reserve Board and its counterparts in other countries, fiscal policies of the United States government and other global political conditions, liquidity in capital markets, the demand for capital by

commercial enterprises and consumers, new financial products, competitive response to changing conditions within the industry, trade balances, the changing values of real estate, currencies, commodities, and other assets, and other factors.

Management policies and practices the Board considers in establishing corporate performance objectives include, but are not limited to, management of the Corporation’s balance sheet and product pricing in a manner which will provide consistent growth in long-term financial results for Shareholders, growth in financial products offered by the Corporation’s,Corporation, adherence to internal controls, management of the credit risk of Corporation’s loan portfolio, the results of internal, regulatory and external audits, service quality delivered to the Corporation’s customers, service quality of “back office” support departments provided to those offices and departments directly delivering products and services to the Corporation’s customers, maintenance of operating policies and procedures which remain appropriate for risk management in a dynamic environment, timely and efficient integration of acquired companies, operational efficiencies, and capital management practices.

RPS shares represent awards of Westamerica’s common stock subject to achievement of performance objectives established by the Compensation Committee. The Amended and Restated Plan of 1995 (“Amended Stock Option Plan”) defines the performance factors the Board must use in administering RPS grants as one or more of the following: earnings, diluted earnings per share, revenue and revenue per diluted share, expenses, share price, return on equity, return on equity relative to the average return on equity for similarly sized institutions, return on assets, return on assets relative to the average return on assets for similarly sized institutions, efficiency ratio (operating expenses divided by operating revenues), net loan losses as a percentage of average loans outstanding, nonperforming assets, and nonperforming assets as a percentage of total assets.

In addition to establishing corporate performance objectives, the Compensation Committee also establishes individual goals for the CEO. In regard to the other executives named in the accompanying tables, the CEO recommends divisional and individual performance objectives to the Compensation Committee, which considers, discusses, adjusts as necessary, and adopts such performance objectives.

12

At the beginning of each calendar year, the Compensation Committee reviews corporate, divisional, and individual performance against the performance objectives for the year just completed. After thorough review and deliberation, the Compensation Committee determines the recommended amount of individual cash incentives and stock-based incentive awards. The Compensation Committee reports such incentives to the Board of Directors. Meetings of the Compensation Committee and Board of Directors routinely occur in January, immediately following the closure of the calendar year for which performance is measured for incentive compensation purposes.

Stock Grants

Long-term stock grants may only be awarded under Shareholder approved stock-based incentive compensation plans. The Amended Stock Option Plan was approved by Shareholders on April 24, 2003. The Amended Stock Option Plan amended the Corporation’s Stock Option Plan of 1995, which was previously approved by Shareholders on April 25, 1995. The Corporation’s Proxy Statement dated March 17, 2003, as filed with the Securities and Exchange Commission (the “SEC”) on that date, summarizes the Amended Stock Option Plan’s changes from the predecessor plan. Such changes included:

disallowing re-pricing stock options for poor stock performance;

limiting the number of shares that may be awarded, and;

requiring the Compensation Committee to meet the definition of independence to enable any award intended to qualify as “performance based compensation” to meet Section 162(m) of the Internal Revenue Code.

The Amended Stock Option Plan allows four types of stock-based compensation awards:

Incentive Stock Options(“ISO”) allow the optionee to buy a certain number of shares of Westamerica common stock at a fixed price, which is established on the date of the option grant. ISOs are intended to meet the requirements of Section 422 of the Internal Revenue Code which provide advantages if certain conditions are met. If the optionee holds the acquired stock for the designated holding period, the optionee defers the timing of recognizing taxable income related to exercising the ISO. If the optionee complies with the ISO requirements, the Corporation does not receive a corporate tax deduction related to the shares issued.

Nonqualified Stock Options(“NQSO”) also give the optionee the option to buy a certain number of shares of Westamerica common stock at a fixed price, which is established on the date of grant. Unlike ISOs, NQSO do not allow deferral of taxable income for the optionee. At the time NQSO are exercised, the optionee incurs taxable income equal to the spread between the exercise price and the market price of the stock, and the Corporation receives a corporate tax deduction in the same amount.

Stock Appreciation Rights(“SAR”) provide the holder a cash payment equal to the difference between the fair market value of the Corporation’s common stock on the date the SAR is surrendered and the fair market value of the Corporation’s common stock on the date the SAR was granted. The optionee incurs taxable income at the time the SAR is settled and the Corporation getsreceives a corporate tax deduction in the same amount.

13

Restricted Performance Share Grants(“RPS”), as noted above, are awards of the Corporation’s common stock isthat are subject to the achievement of performance objectives. Award recipients receive shares at the end of the performance measurement period only if performance objectives are achieved. The number of shares received is subject to the level of performance achieved. The award recipient incurs taxable income at the time any RPS vests and the Corporation receives a corporate tax deduction in the same amount.

Determination of Awards to Grant

In determining which type of stock-based compensation awards to grant, the Compensation Committee considers the attributes of each form of incentive. For example, the ability to motivate management to make decisions based on the long-term interests of Shareholders, the desire to compensate with shares rather than cash, and the tax consequences of each type of award. The Compensation Committee retains the latitude to utilize all forms of incentives provided under the Amended Stock Option Plan. In the current and preceding years, the Compensation Committee has utilized NQSO and RPS based on the motivational aspects of stock price appreciation, the settlement in shares rather than cash, and the preservation of tax deductions for the Corporation. At February 26, 2007,25, 2008, the Corporation had no ISO or SAR awards outstanding.

Determination of Option Exercise Price

The Amended Stock Option Plan also requires the exercise price of each NQSO or ISO to be no less than one hundred percent (100%) of the fair market value of the Corporation’s common stock on the date of grant. As described above, the Amended Stock Option Plan does not allow re-pricing stock options for poor stock performance.

Stock-based compensation awards are submitted by the Compensation Committee to the full Board of Directors for review. As described above, these meetings have routinely occurred in the January immediately following the closure of the calendar year for which performance is measured for incentive compensation purposes. The Compensation Committee meeting has routinely been held during the same week as the related Board of Directors meeting. These January meetings follow by no more than ten business days, the Corporation’s public disclosure of its financial earnings results for the preceding year. As a result, stock option grants are awarded, and the exercise price of such grants are determined, at a time when the Corporation has broadly disseminated its financial condition and current operating results to the public. The Corporation’s outstanding stock option grants are dated, and related stock option exercise prices are determined, on the January dates the Compensation Committee and Board of Directors meet approve such grants.(1)

Long-Term Incentive Attributes

The Board of Directors has designated the Compensation Committee as the administrator of the Amended Stock Option Plan. The Compensation Committee reports to the Board the terms and conditions of stock option awards. In carrying out this responsibility, the Compensation Committee designs such awards as long-term incentives. The terms and conditions of currently outstanding awards include:

NQSO vest one-third (1/3) on each anniversary of the grant date. As such, NQSO grants become fully vested over a three-year period. NQSO grants expire on the tenth anniversary of the grant date. The Corporation does not pay dividends on shares underlying NQSO grants until the optionee exercises the option and the shares are outstanding on a dividend record date.

RPS awards vest three years following the grant date, only if corporate performance objectives are achieved over the three-year period. The Corporation does not pay dividends on RPS shares until vesting occurs and shares awarded become outstanding on or before a dividend record date.

Compensation for the Chairman, President & CEO

Mr. Payne performs two functions for the Corporation. These two functions tend to be compensated separately at similarly sized banking institutions. Mr. Payne serves as Chairman of the Board and Chief Executive Officer with responsibilities including oversight of the organization and external strategic initiatives. Mr. Payne also serves as President and Chief Operating Officer with responsibilities including daily management of internal operations. Mr. Payne’s total compensation reflects these broad responsibilities. Consistent with the overall compensation philosophy for senior executives, Mr. Payne’s compensation has a greater amount of pay at-risk through incentives than through base salary. Since Mr. Payne is compensated as an executive, he is not eligible to receive compensation as a director.

(1) | Due to merger and acquisition activity, the Corporation converts stock option grants outstanding for acquired companies based on the terms and conditions of related merger agreements. The dating of such converted stock options generally remains as originally dated by the acquired company. As a result, the Corporation at times has options outstanding related to acquisitions with grant dates different from its routine stock option granting practices. |

As noted on page 28 of the proxy under the Pension Benefits Table, during 1997 the Corporation entered into a nonqualified pension agreement (“Pension Agreement”) with Mr. Payne in consideration of Mr. Payne’s agreement that RPS granted in 1995, 1996 and 1997 would be canceled. In entering the Pension Agreement, the Board of Directors considered the following:

14Mr. Payne had a significant beneficial interest in Corporation common stock, which was more than adequate to continue to provide motivation for Mr. Payne to continue managing the Corporation in the best interests of Shareholders.

In 1997, the Corporation had consummated its largest acquisition, with significant total asset growth of approximately 51 percent. One of the Board’s objectives was to provide a compensation mechanism providing retention features for Mr. Payne. Retention of Mr. Payne as President and Chief Executive Officer was desired following the Corporation’s significant growth. The RPS shares surrendered for the Pension Agreement were scheduled to vest on dates in 1998, 1999 and 2000, while the Pension Agreement was not fully vested until December 31, 2002. Additionally, the 20-year certain pension provided under the Pension Agreement commences upon Mr. Payne’s attainment of age 55, while Mr. Payne was age 42 at the time of entering the Pension Agreement.

The economic value of the surrendered RPS and the Pension Agreement were considered equivalent based on actuarial assumptions.

Compensation Awarded to Named Executive Officers

Base salaries for participants in the executive compensation program are generally limited to foster an environment where incentive compensation motivates and rewards corporate, divisional, and individual performance. As such, base pay increases are generally infrequent and limited.

The non-equity cash incentive formula has the following components:

“Target” Cash Incentive | X | Composite Corporate, Divisional and Individual Performance Level | = | Cash Incentive Award |

In structuring performance goals for the named executive officers, the Compensation Committee emphasizes goals, which if achieved, will benefit the overall Corporation. As such, senior management level positions have high relative weighting on corporate objectives, and divisional leadership positions also have significant weighting on divisional objectives. The “target” cash incentive and the weighting of goals for the named executive officers for 2007 performance were as follows:

| “Target” Cash | Goal Weighting | ||||||||||

| Incentive | Corporate | Divisional | Individual | ||||||||

Mr. Payne | 381,000 | 80 | % | –– | 20 | % | |||||

Mr. Thorson | 82,000 | 55 | % | 25 | % | 20 | % | ||||

Ms. Finger | 82,000 | 55 | % | 25 | % | 20 | % | ||||

Mr. Zbacnik | 60,500 | 55 | % | 35 | % | 10 | % | ||||

Mr. Hansen | 73,900 | 55 | % | 35 | % | 10 | % | ||||

The Compensation Committee establishes corporate goals with the intent to balance current profitability with long-term stability of the Corporation and its future earnings potential. The 2007 corporate performance goals related to current year “profitability” included return on equity, return on assets and diluted earnings per share. The performance goals designed to maintain the long-term stability of the Corporation include “quality” and “control” components. The “quality” measures include loan portfolio quality measures (classified loans and other real estate owned, non-performing loans and other real estate owned, and net loan losses to average loans) and service quality measures (external service quality to customers and internal service quality of support departments and branches). The “control” measures include non-interest expense to revenues (efficiency ratio), the level of non-interest expenses, and below satisfactory internal audit results. By maintaining both current year “profitability” goals and longer-term “quality” and “control” goals, Management has a dis-incentive to maximize current earnings and the expense of longer-term results.

For 2007, the Compensation Committee anticipated a difficult operating environment with a higher than usual degree of uncertainty based on economic conditions and competitive trends in the banking industry. As a result, the Committee determined to establish only “target” performance goals for the current year and to exercise a certain degree of judgment in reviewing performance against the “target” corporate performance goals.

The Compensation Committee monitors the banking industry’s operating environment throughout the year, and may exercise discretion in adjusting the corporate performance objectives. The Compensation Committee determined the 2007 operating environment was generally characterized as follows:

Economic growth was firm in the first half of the year. However, credit markets deteriorated in the second half due to issues in the sub-prime mortgage markets. The Federal Reserve began easing monetary policies and deploying various tactics to address weakening economic conditions.

The interest rate “yield curve” remained flat or inverted throughout the first half of the year, providing little opportunity for adequate profitability between intermediate term interest rates on financial assets and shorter term interest rates on financial liabilities. Competitive interest rates and liberalized underwriting standards on commercial loan products remained in the market place for much of the year reducing the quality of loans available to the Corporation. Competitive deposit pricing intensified, particularly in higher cost deposit products, due to reduced liquidity in credit markets.

The Compensation Committee also considered management’s response to the current operating environment including:

In Management’s judgment, incremental loan, investment and deposit business would not benefit the Corporation’s profitability over the longer term.

Management chose to limit loan growth and did not replace liquidating investment securities as interest rate spreads were not considered adequate to provide appropriate levels of long-term profitability.

Management maintained conservative loan underwriting practices to maintain the credit quality of the Corporation’s loan portfolio, which reduced the Corporation’s opportunities for loan growth due to trends in competitive underwriting practices.

The Compensation Committee chose to make adjustments to actual results to take into account the impact of the operating environment and various non-recurring non-operating transactions such as Visa litigation liability accruals, life insurance gains, tax refunds, and gains from the sale of real estate. The goals for 2007 “target” corporate performance and adjusted actual results were:

| Performance “Target” | Adjusted Actual Results | |||||||

Profitability Goals: | ||||||||

Return on average shareholders’ equity | 22.7 | % | 22.9 | % | ||||

Return on average assets | 1.99 | % | 2.01 | % | ||||

Diluted earnings per share | $ | 3.14 | $ | 3.09 | ||||

Quality Goals: | ||||||||

Classified loans and other real estate owned | $ | 25 million | $ | 25 million | ||||

Non-performing loans and other real estate owned | $ | 6.2 million | $ | 5.7 million | ||||

Net loan losses to average loans | 0.06 | % | 0.11 | % | ||||

Service quality | Improving | Improving | ||||||

Control Goals: | ||||||||

Non-interest expense to revenues (efficiency ratio) | 40.0 | % | 39.7 | % | ||||

Non-interest expenses | $ | 103.1 million | $ | 98.9 million | ||||

Below satisfactory internal audits | none | none | ||||||

In reviewing the operating environment, management’s response to the operating environment, and adjusted results compared to “target” performance goals, the Compensation Committee determined corporate performance to be 115.2% of target goals.

As described above, divisional and individual goals are used in conjunction with corporate performance goals to determined cash bonus awards.

In addition to daily management responsibilities, Mr. Payne’s individual goals included:

Management of non-interest income projects;

Completion of comprehensive strategic planning process;

Activities related to merger and acquisition opportunities;

Review of internal controls and risk management practices, and;

External communication objectives.

Based on individual performance against these goals, the Committee determined Mr. Payne’s individual performance to be 130%. As a result, Mr. Payne’s composite corporate and individual performance level was 118%.

In addition to routine on-going divisional responsibilities, Mr. Thorson managed the Finance Division toward functional goals, which included:

Service quality improvements with external vendors and internal departments;

Comprehensive review of divisional systems and technology;

Manage the conversion of incentive compensation software, and;

Support adoption of new SEC disclosure requirements.

Based on the Finance Division’s results, the Committee determined divisional performance to be 119%.

In addition to daily management responsibilities, Mr. Thorson’s individual goals included:

Personnel recruitment, development, and succession planning to meet the long-term objectives of the Corporation;

Administer the strategic planning process;

Review, assess and recommend changes to processes applied to meet the objectives of the Sarbanes-Oxley Act of 2002, and;

Review regulatory relationships and respond to regulatory inquiries.

Based on individual performance against these goals, the Committee determined Mr. Thorson’s individual performance to be 131%. As a result, Mr. Thorson’s composite corporate, divisional, and individual performance level was 119%.

In addition to routine on-going divisional responsibilities, Ms. Finger managed the Treasury Division toward functional goals, which included:

Investment portfolio management;

Manage completion of Community Reinvestment Act investment goals;

Manage the asset and liability management process, including funds management;

Manage the daily funding of operations, and;

Administer career development practices within the division.

Based on the Treasury Division’s results, the Committee determined divisional performance to be 116%.

In addition to daily management responsibilities, Ms. Finger’s individual goals included:

Meeting goals for merchant credit card processing revenues and losses;

Personnel recruiting and development for merchant credit card processing operations;

Financial analysis of merger and acquisition opportunities, and;

Management of any corporate litigation.

Based on individual performance against these goals, the Committee determined Ms. Finger’s individual performance to be 128%. As a result, Ms. Finger’s composite corporate, divisional and individual performance level was 118%.

In addition to routine on-going divisional responsibilities, Mr. Zbacnik managed the Credit Division toward functional goals which included:

Credit quality trends including net loan charge-offs, non-performing assets, delinquent loans, and classified and criticized loans;

Maintain consistency of loan underwriting across all lines of business;

Updating and reinforcing customer service standards;

Updating divisional policies and procedures, and;

Ensuring compliance with banking regulations.

Based on the Credit Division’s results, the Committee determined divisional performance to be 113%.

In addition to daily management responsibilities, Mr. Zbacnik’s individual goals included:

Personnel development, recruitment, and succession planning to meet the long-term objectives of the Corporation;

Providing superior service quality to the Banking Division, and;

Preparation for regulatory examinations.

Based on individual performance against these goals, the Committee determined Mr. Zbacnik’s individual performance to be 119%. As a result, Mr. Zbacnik’s composite corporate, divisional and individual performance level was 115%.

In addition to routine on-going divisional responsibilities, Mr. Hansen managed the Operations and Systems Division toward functional goals, which included:

Management of non-interest expense levels;

Managing non-interest income improvements;

Improving and maintaining quality of services provided by divisional departments to branch offices;

Staff development, and;

Management of operational risk management initiatives.

Based on the Operations and Systems Division’s results, the Committee determined divisional performance to be 114%.

In addition to daily management responsibilities, Mr. Hansen’s individual goals included:

Developing divisional management succession plans;

Managing the re-alignment of the division;

Reviewing and updating divisional service quality standards, and;

As the newly appointed division manager, conduct an orderly transition to his management of the division.

Based on individual performance against these goals, the Committee determined Mr. Hansen’s individual performance to be 100%. As a result, Mr. Hansen’s composite corporate, divisional and individual performance level was 113%.

Based on the above described performance against objectives, the Committee determined cash incentive awards as follows:

| “Target” Cash Incentive | X | Composite Corporate Divisional and Individual Performance Level | = | Cash Incentive Award | |||||||

Mr. Payne | 381,000 | 118 | % | 450,000 | |||||||

Mr. Thorson | 82,000 | 119 | % | 97,800 | |||||||

Ms. Finger | 82,000 | 118 | % | 96,700 | |||||||

Mr. Zbacnik | 60,500 | 115 | % | 69,300 | |||||||

Mr. Hansen | 73,900 | 113 | % | 84,500 |

The size of stock grants is determined by corporate performance using the stated formula. For achievement of corporate performance in 2007, the following stock grants were awarded in January 2008:

| “Target” Nonqualified Stock Option Grant | X | Corporate Performance Level | = | Nonqualified Stock Option Award | |||||||

Mr. Payne | — | 115.2 | % | — | |||||||

Mr. Thorson | 20,100 | 115.2 | % | 23,148 | |||||||

Ms. Finger | 20,100 | 115.2 | % | 23,148 | |||||||

Mr. Zbacnik | 16,400 | 115.2 | % | 18,851 | |||||||

Mr. Hansen | 18,200 | 115.2 | % | 20,930 | |||||||

| “Target” RPS Grant | X | Corporate Performance Level | = | RPS Award | |||||||

Mr. Payne | 8,200 | 115.2 | % | 9,440 | |||||||

Mr. Thorson | 2,500 | 115.2 | % | 2,850 | |||||||

Ms. Finger | 2,500 | 115.2 | % | 2,850 | |||||||

Mr. Zbacnik | 2,000 | 115.2 | % | 2,310 | |||||||

Mr. Hansen | 2,200 | 115.2 | % | 2,560 | |||||||

RPS awards vest three years following the grant date, only if certain corporate performance objectives are achieved over the three-year period. In January 2008, the Compensation Committee evaluated the three-year corporate performance objectives were met for RPS awards granted in January The Corporation does not pay dividendsperformance objectives for the RPS granted in January 2005 included:

3-year cumulative diluted earnings per share (EPS);

3-year average of annual return on average total assets (ROA);

3-year average of annual return on average shareholders’ equity relative to industry average ROE (ROE differential);

Ending non-performing assets to total assets (NPA); and

3-year average of annual growth in revenues per share (RevPS growth).

The RPS would vest if any one of the following performance results were achieved:

4 of 5 objectives reaching “threshold” performance level;

3 of 5 objectives reaching “target” performance level, and;

2 of 5 objectives reaching “outstanding” performance level.

The goals and achieved results were:

| Threshold | Target | Outstanding | Result | |||||||||||

EPS | $ | 10.00 | $ | 10.40 | $ | 10.85 | Below Threshold | |||||||

ROA | 2.10 | % | 2.15 | % | 2.20 | % | Threshold | |||||||

ROE differential | 3.0 | % | 3.5 | % | 4.5 | % | Outstanding | |||||||

NPA | 0.50 | % | 0.35 | % | 0.20 | % | Outstanding | |||||||

RevPS growth | 4.0 | % | 5.0 | % | 6.0 | % | Below Threshold | |||||||

With two of the five goals achieved at “outstanding” performance level, the Compensation Committee determined the RPS shares until vesting occurs and shares awarded become outstanding on a dividend record date.in 2005 were vested upon achievement of three year goals.

Nonqualified Deferred Compensation Programs

The Corporation maintains nonqualified deferred compensation programs to provide senior and mid-level executives facilities to defer compensation in excess of the annual limits imposed on the Corporation’s “401(k)” plan. The Corporation believes these tax deferral programs enhance loyalty and motivate retention of executives. These programs allow executives to defer cash pay and RPS shares upon vesting. The programs also allow Directors to defer Director fees.

Cash pay deferred in the program accumulates in accounts in the names of the participating Directors and executives. The Corporation credits the balance of these accounts with interest using an interest rate that approximates the crediting rate on corporate-owned life insurance policies, which finance the cash pay deferral program. Deferrals and interest credits represent general obligations of the Corporation.

The common stock the Corporation issues to executives upon the vesting of RPS grants may be deferred into the program and deposited into a “Rabbi Trust.” Since these shares are outstanding shares of Corporation’s common stock, the Corporation pays dividends on these shares.shares at the same rate paid to all shareholders. The shares held in the “Rabbi Trust” are subject to claims by the Corporation’s creditors.

Compensation in the Event of a Change in Control

The banking industry has significant merger and acquisition activity. To promote retention of senior executives, unvested NQSO and RPS grants contain “change in control” provisions, which trigger full vesting upon a change in control.

The Corporation also maintains a Severance Payment Plan covering all employees to promote employee retention. The Severance Payment Plan provides salary continuation benefits for employees in the event of a change in control. The amount of salary continuation benefits is based on years of service and corporate title, but in no event exceed the equivalent of one times annual salary. All named executive officers are eligible for one year’s salary under the plan.

Employment Contracts

None of the executives named in the accompanying tables have employment contracts with the Corporation.

Compensation in the Event of a Change in Control

The banking industry has significant merger and acquisition activity. To promote retention of senior executives, unvested NQSO and RPS grants contain “change in control” provisions, which trigger full vesting upon a change in control. The Compensation Committee determined that these provisions were appropriate in order to retain executives to continue managing the Corporation after any change in control was announced through its ultimate consummation. Since none of the named executive officers have entered employment contracts with the Corporation, they serve in an “at-will” capacity and could terminate their employment at any time. The Compensation Committee felt it would be in the best interests of shareholders to have a retention mechanism in place to provide continuity of management during a change in control process. Further, the Committee expects the named executive officers would be terminated by an acquiring institution rather than retained in a similar functional capacity.

The Corporation also maintains a Severance Payment Plan covering all employees to promote employee retention. The Severance Payment Plan provides salary continuation benefits for employees in the event of a change in control. The amount of salary continuation benefits is based on years of service and corporate title, but in no event exceed the equivalent of one times annual salary. All named executive officers are eligible for one year’s salary under the plan.

Other

Internal Revenue Code (“IRC”) Section 162(m) places a limit of $1,000,000 on the amount of compensation that may be deducted by the Corporation in any year with respect to certain of the Corporation’s highest-paid executives. Certain “performance-based compensation” is not counted toward this limit. The Corporation intends generally to qualify compensation paid to executive officers for deductibility under the IRC, including Section 162(m), but reserves the right to pay compensation that is not deductible under Section 162(m).

15

Board Compensation Committee Report

We, the Compensation Committee of the Board of Directors of the Corporation, have reviewed and discussed the Compensation Discussion and Analysis with management. Based on that review and discussion, we have recommended to the Board of Directors inclusion of the Compensation Discussion and Analysis in this Proxy Statement and the Company’sCorporation’s Annual Report on Form 10-K for the year ended December, 31, 2006.2007.

Submitted by the Employee Benefits and Compensation Committee

Patrick D. Lynch, Chairman

Etta Allen

Arthur C. Latno, Jr.

Ronald A. Nelson

Compensation Committee Interlocks Andand Insider Participation

No member of the Compensation Committee is a current or former officer or employee of the Corporation or any of its subsidiaries, or entered into (or agreed to enter into) any transaction or series of transactions with the Corporation or any of its subsidiaries with a value in excess of $120,000. None of the executive officers of the Corporation has served on the Board of Directors or on the Compensation Committee of any other entity, where one of that entity’s executive officers served either on the Board of Directors or on the Compensation Committee of the Corporation.

16

2006 Summary Compensation Table

The following table sets forth summary compensation information for the year ended December 31, 20062007 for the chief executive officer, chief financial officer and each of the other three most highly compensated executive officers as of the end of the last fiscal year. These persons are referred to as named executive officers elsewhere in this proxy statement.

SUMMARY COMPENSATION TABLE FOR FISCAL YEAR 2006

Name and Principal Position | Year | Salary | Stock Awards (1) | Option Awards(2) | Non-Equity Incentive Plan Compensation (3) | Change in Pension Value and Nonqualified Deferred Compensation Earnings(4) | All Other Compensation (5)(6) | TOTAL | |||||||||||||||

David L. Payne | 2006 | $ | 371,000 | $ | 0 | $ | 1,128,333 | $ | 450,000 | $ | 0 | $ | 22,607 | $ | 1,971,940 | ||||||||

Chairman, | |||||||||||||||||||||||

President & CEO | |||||||||||||||||||||||

Robert A. Thorson | 2006 | 135,000 | 90,996 | 96,938 | 97,200 | 9,286 | 13,398 | 442,818 | |||||||||||||||

SVP & Chief | |||||||||||||||||||||||

Financial Officer | |||||||||||||||||||||||

Jennifer J. Finger | 2006 | 129,996 | 124,328 | 128,450 | 96,800 | 7,124 | 18,315 | 505,013 | |||||||||||||||

SVP & Treasurer | |||||||||||||||||||||||

Frank R. Zbacnik | 2006 | 120,960 | 100,908 | 104,353 | 69,300 | 11,235 | 16,990 | 423,746 | |||||||||||||||

SVP & Chief | |||||||||||||||||||||||

Credit Administrator | |||||||||||||||||||||||

Dennis R. Hansen | 2006 | 130,008 | 32,729 | 65,094 | 84,200 | 6,559 | 29,571 | 348,161 | |||||||||||||||

SVP | |||||||||||||||||||||||

Stock | Option | Non-Equity | Change in | All Other | |||||||||||||||||||